Intelligent risk prevention with Funk Beyond Insurance

Sensors, artificial intelligence and other modern technologies can be used for loss prevention these days. Under the name ‘Beyond Insurance’, Funk is offering a new service at the interface between risk and insurance management. On this page, you can discover what makes our Beyond Insurance model special and how Funk operates as a matchmaker for clients, technology providers and insurers. We’ll also use successful project examples to show how innovative technology is more than just an investment for the distant future, but rather a tool that creates true added value in insurance management even today. Have a look!

In the age of digitisation, many companies are under growing pressure to innovate, regardless of their field of business or the size of their business. Behind this pressure hide various sources of concern: companies worry that the competition will pass them by thanks to technological progress, that customers’ digital expectations cannot be met or that missing interfaces will lead to them being excluded from the supply chain. To counter these challenges and maintain a future-ready business model, companies must act now.

One essential aspect is the integration of modern technology in a company’s individual process landscape. But the market for potential solution providers and technology start-ups is as overwhelmingly unclear as it is fast-paced. And it also becomes difficult for companies when introducing new technology ends up being ‘digitisation for digitisation’s sake’ as opposed to a solution to a specific entrepreneurial problem. After all, the potential users do not generally have a lot of leeway for experimental projects alongside their core business.

‘When applied consistently, the new technology can help reduce many potential basic losses.’

Digitisation with added value

This is exactly where our new service, Funk Beyond Insurance, comes in: we use the possibilities of digitisation to create problem-oriented, targeted and direct benefits for our clients’ risk and insurance management. Hendrik Löffler, a Member of the Funk Management Board, says on this topic, ‘When applied consistently, the new technology can help reduce many potential basic losses.’ Funk has already implemented the first real-world solutions in collaboration with established companies and a large partner network of technology-oriented start-ups. Along the way, the Beyond Insurance team always focuses on tackling specific challenges, in order to offer clients as much added value as possible using big data, blockchain and the like.

Discover practical examples now

With Funk Beyond Insurance we actively use digitisation to implement intelligent risk management. Examples from our clients and technology partners show you what that looks like in practice.

See the practical examples

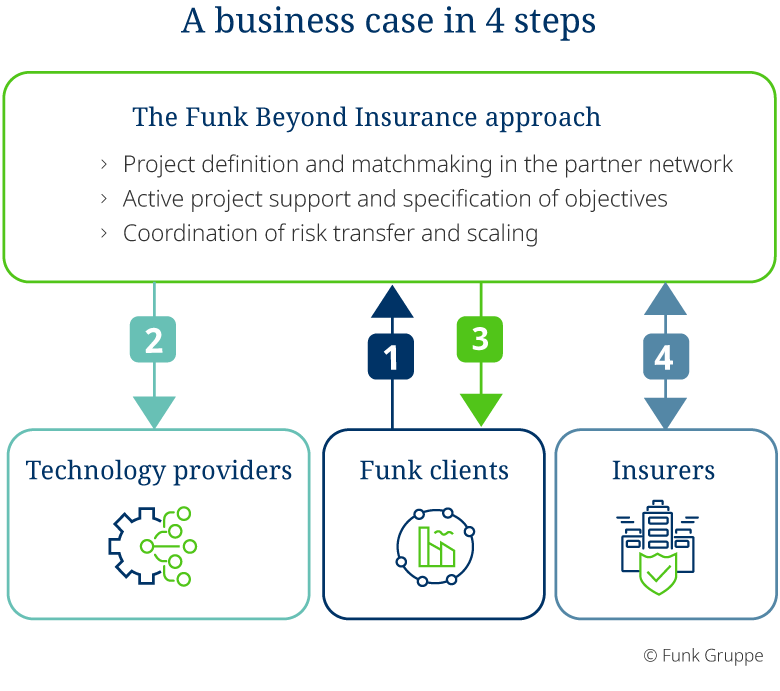

1 Kick-off

Auch 2024 stehen sie unangefochten an erster Stelle. Letztes Jahr geprägt von Supply-Chain-Angriffen und verstärkt durch geopolitische Spannungen.

2 Matchmaking

- Search and selection process based on Funk expertise within the constantly growing Beyond Insurance partner network

- Consolidation of entrepreneurial problem with suitable solutions from selected technology providers

3 Project support

- Help in starting, coordinating, planning and implementing a pilot project as well as subsequent roll-out

- Results: reduced basic losses, improved claims ratios, certainty for business processes, reduced costs and increased efficiency

4 Next level: risk transfer/scaling

- Design of concepts for unconventional and complex risks, in order to facilitate the innovative transfer of risks

- Development of additional areas of potential for increased efficiency and reduced costs

- Development of innovative business models, e.g. parametric insurance or self-steering of risk processes

Funk acts as a matchmaker between companies looking for modern solutions and a technology-oriented provider market. In doing so, we combine our years of industry knowledge and our position as an established player in the insurance sector with a hand-picked network of innovative solution partners. When it comes to digitisation, Funk Beyond Insurance enables us to once again give you our core promise: to always provide the best recommendation.

Your added value

- Digitisation with clearly formulated objectives that are sensible for entrepreneurs: risk prevention and risk reduction

- Side benefits: optimised processes, reduced costs and increased efficiency

- Creation of future-proof technical infrastructures in companies as the basis for further innovation

- Medium and long-term access to innovative insurance products

- Potential to save on premiums or ensure future insurability

Our services

- Central link between three structured networks: insurers, corporate clients from all industries and tried-and-tested technology providers

- Connection of entrepreneurial problems with verifiably suitable solutions from innovative start-ups and established tech companies

- Integration of emerging digitisation projects with innovative insurance solutions

- Communication of content and project support

- Decades of expertise in the fields of risk consulting and industrial insurance

Practical examples

How AI is reducing the risk of fire in the paper sector

The risk of fire is very high in the paper industry – ultimately the materials in this sector are highly flammable. An innovative defect and residual current monitoring solution allows for potential ignition sources to be detected early.

Learn more

When the platform takes care of data protection

User consent is required for any form of data processing – this is a challenge that website and app operators have faced since the GDPR came into force. A consent management platform keeps marketing measures on the right side of the law.

Learn more

How sensor screws detect loads on machines

When technical production systems fail, this regularly leads to major financial damage. Sensor data and software analyses show whether load limits are being observed – and help technical personnel optimise their machines.

Learn more

Meeting guidelines with blockchain technology

In a production facility for sustainable textiles, compliance with emission thresholds must be recorded in a fail-safe way – in order to pass audits and to protect a good reputation. Blockchain and a cloud connection digitally seal the data.

Learn more

Optimised processes in paper production thanks to AI

Fluctuating values on the machines can lead to rejected products and downtime in paper production. An intelligent software solution analyses the data so that the parameters can be adapted and the risks are minimised.

Learn more

How drones detect damage to photovoltaic systems

Operators of photovoltaic systems have to carry out regular inspections. The use of modern drone technology makes this process more efficient and offers interactive data processing, so that damage can be repaired quickly.

Learn more

Weather-based sales planning for retailers

In the ages of climate change and digitisation, precise weather data is becoming a strategic competitive edge for many economic sectors – a factor that more and more often determines a company’s economic success.

Learn more

Do you want to speak with us about Funk Beyond Insurance?

Manuel Zimmermann | Dr Alexander Skorna | Benedikt T. Brahm

+49 (0)40 359 140

Contact by e-mail